IT Sector Stocks India – An Overview

By Philip Mudartha

Bellevision Media Network

19 Jan 2023:

Preface:

For several years, BV has been publishing my exclusive articles on a vast array of subjects. However, I must say that the response from Belleans, both residents and the diaspora has been less than encouraging. I am at a loss to understand their area of interest, if any. Therefore, to test the waters, so to say, I chose the subject of ‘investment in stocks’. I begin with an overview of Indian Information Technology (IT) stocks.

The COVID and IT infrastructure:

The IT sector is one of the most crucial sectors of the Indian industry. It is one of the largest drivers of export revenue for the country. The industry currently contributes about 8% of GDP and is expected to contribute to about 10% by 2025. India is currently the largest IT services provider in the world. India has an edge primarily due to the availability of English-educated, highly skilled and comparably cheaper manpower. India is the leading sourcing destination in the world, serving about 55% of the global service out-sourcing market of an estimated size of USD 185-190 billion and a 38% market share of the Business Processes Outsourcing (BPO) business.

With the onset of COVID-19, governments across the world restricted movement of people to avoid the spread of the virus. To cope with national lockdowns, most companies resorted to “work from home” for their employees and continued their daily operations. This presented a great opportunity for IT companies as businesses across the world have been updating and developing their IT infrastructure in order to ensure seamless working among employees while maintaining constant interaction with their clients.

Besides the importance of having a proper IT infrastructure to ensure efficient continuation of businesses, the pandemic accelerated the push towards digitalisation across the globe for all companies ranging from local medium, small and micro enterprises (MSMEs) to large conglomerates. The businesses are now focusing towards developing and upgrading their infrastructure for both consumer facing and operations related services. Further, a lot of IT enabled businesses have emerged during these times. This environment provides the IT industry with great business opportunities over the long term driving growth for IT companies.

IT companies carry almost zero debt on their balance sheets. They are usually asset light as no major capex is incurred because the focus is to provide services which enables them to generate high profitability. Their Return on Equity (ROE) ratio is in the range of 20-30%, which is a huge attraction to the investors.

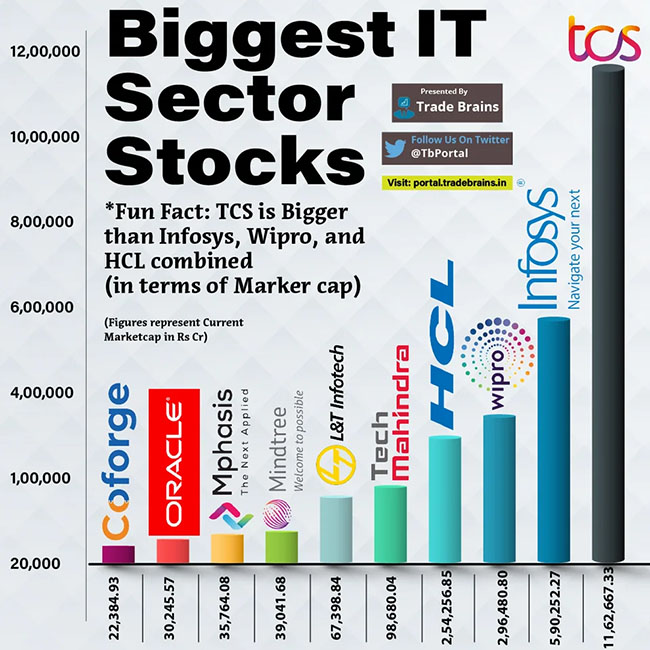

Best IT Stocks to Buy:

An investor should be on the lookout for certain factors which can help them identify stronger companies in the sector, such as:

* Identify the verticals and their size in the revenue of the company: IT companies service various verticals such as Banking and Financial Services, Insurance (BFSI), Pharma, Communications, Media & Technology (CMT), Energy & Utilities and Manufacturing among others. The key is to find companies which are well diversified across verticals and services. Verticals which are more stable and have sound growth prospects will drive returns for the companies.

* Identify the geographic distribution of revenues: IT companies service countries across the world such as the US, Europe, Rest of The World (ROW). Investors need to see the revenue share from different countries and also assess the currency exchange rate movement of India with that of the foreign currency to identify any forex risks which significantly affect the earnings of the company. For example, a depreciating Indian Rupee (INR) benefits the IT companies because most of their revenue comes from the US and Europe. Watch out for constant currency revenue figures and INR revenues.

* Identify the financial performance of the company: One needs to look at the performance of the company over time and against its peers using metrics such as ROE, Return on Capital Employed (ROCE), Price/Earnings (P/E) ratio, Cash flow from Operations and profit margin ratios. Such metrics give an understanding about the financial position of the company and whether its financials are strong to deal with in challenging times.

* An investor also needs to assess the product offerings and the order inflow for the companies so as to ascertain the revenue flows expected for the company. Another aspect to keep an eye out for is the R&D spending of the company as technology is significantly influenced by new discoveries which can impact the business.

* An investor must keep an eye on cash dividends, bonuses, rights and buybacks (if any). IT companies are known to regularly give out dividends. They sometimes conduct share buybacks as a way of giving back money to shareholders. Investors should assess the frequency and the amount of these which can also indicate stability in earnings and returns on investments. While companies conducting these activities are good for shareholders, one should assess the fact that the company maintains enough cash for expenses and inorganic and organic growth opportunities as well.

Portfolio Companies in IT Stocks:

1. Tata Consultancy Services Ltd (TCS)

TCS is the largest IT company in India by Market cap and the world’s largest IT Services provider. The company is involved in providing a wide spectrum of services such as IT Services, Consultancy, business solutions, digital transformation, and IT products and platforms. The company is also foraying into newfound and developing technologies such as cloud-based computing, machine learning, AI and Blockchain-based technology. Its majority revenue segment is BFSI which forms 40% of the total revenue pie for the company followed by Retail and Consumer Packaged Goods (CPG), CMT, Manufacturing, Life Sciences & Healthcare and Energy & Utilities. TCS’ major revenue generation is from North America (US & Canada) contributing about 51.3%, UK and Europe around 31.9% while India is the least at 5.1%.

The company has a proven track record which is reflected in the company’s financials as it has been delivering industry leading results such as 5-year average RoE of 37.2%; an operating profit margin of 26.6% and high cash flow generating business with Net Cash flow at about Rs 5,630 crore for FY22. TCS has also seen consistent growth with revenue growing at a CAGR of 10.2% over the last 5 years while the net profits saw a 7.8% CAGR for the same period.

Though the company has delivered strong financial performance, the stock carries premium valuations vs its peers. Its P/E ratio is 29.6 vs industry average of 24.2. While the P/E is higher, the premium is justified as TCS has also delivered industry leading growth and returns for shareholders.

The stock has declared flat results for Q3-FY 23. Most analysts assess that the stock has a very expensive market price of Rs 3,390 as on 18th Jan 2023.

Disclaimer: Past performance is not a guarantee for the future. Investors are advised to make their own informed decisions.

2. Infosys Ltd

Infosys is currently the 2nd largest IT service provider in India. The company is engaged in providing a wide array of IT services to clients across the globe such as the US, Europe, Asia and ROW. The company is also engaged in the development of new technologies to better service clients. The verticals it serves are BFSI, Retail & CPG, CMT, Energy & Utilities, Manufacturing and Hi-tech. The geographical breakdown spans across North America, Europe, India and ROW.

The company has delivered a strong financial performance with a 5-year average ROE 25.8% while delivering an Operating profit margin of 24.4%. It has delivered a 12.2% CAGR in the top line and a 9.16% CAGR in the bottom line for the last 5 years. The company currently has a P/E ratio of 27.7, being relatively fairly valued among its peers. Infosys faces risks from whistle-blowers. Infosys has managed this risk with diligence.

Infosys has delivered strong financials for Q3-FY23 with ROCE of 39.8% and hence the stock is bullish at market price of Rs 1,545 as on 18th Jan 2023. According to trendlyne, a premier stock analyst, of 42 analysts, 37 have given strong buy/buy ratings.

Disclaimer: Online brokerages have their own metrics to rate the stocks. Investors are advised to make their own informed decisions.

3. HCL Tech

HCL Tech is a leading global IT Services company. It is ranked among the top five Indian IT services companies in terms of revenue. The company has been focused on transformational outsourcing since its entry into the global market following its IPO in 1999. In FY22, the company revenue grew by 12.8% overall and its IT services grew by 14.5%. The growth in IT services has been the fastest in the past five years. The company has been experiencing good demand from Amazon Web Services (AWS) and thus has been hiring aggressively in this segment.

The company’s Engineering and R&D segment also grew strong at 16.8% in FY22. This segment would be a significant driver of its growth. The company’s margins are improving and its growth coming in line with its top peers. The company also provides an attractive dividend yield of 3.7%. Considering the beaten-down valuations, future growth and margin expansion provide a strong case for the stock.

The ROCE has risen to its record level of 26.51% for Q3-FY23. Market Mojo, an online brokerage with a big base of subscribers has chosen HCL Tech as one of its Mojo Stock with a strong buy rating. The stock traded at Rs 1,114 on 18th Jan 2023.

Disclaimer: Mojo online brokerage has its own metrics to rate the stocks. Investors are advised to make their own informed decisions.

4. Larsen & Toubro Technology Services Ltd (LTTS)

LTTS is a market leader in five key segments: transportation, telecom and hi-tech, industrial products, plant engineering, and medical devices. LTTS is positioned to leverage and capitalize on the emerging opportunities arising from Electric Autonomous and Connected Vehicles, 5G, AI and Digital Products, Digital Manufacturing, Medtech and Sustainability.

The company has a robust financial profile and a debt-free balance sheet, with cash surpluses of Rs. 1970 crore as of March 31, 2022. During FY22, it registered revenue of Rs 6,569.7 crores, a growth of 21% year-on-year (y-o-y) and a Net profit of Rs 957 crores, a growth of 44% y-o-y. The company has a strong track record of ROE and ROCE of 25.2% and 32.7% respectively over the last 3 years.

The current ROE is 24% and hence most online brokerages consider the market price of Rs 3,419 as on 18th Jan 2023 to be very expensive.

Disclaimer: Investors are advised to make their own informed decisions.

5. Persistent Systems Ltd

Persistent was able to produce 5% quarter-on-quarter (q-o-q) growth in the first and second quarters of FY23. This growth was fueled by new business wins with both old and new clients. Persistent will be able to produce 4% q-o-q growth over the coming quarters thanks to a solid deal winning trajectory and a strong pipeline with a trailing 12M total contract value (TCV) of USD 368 million (including renewals, +30% y-y) and new deal TCV of USD228mn (+53% y-y).

The company’s numerous long-term partnerships with well-known global brands have increased its commercial stability and offered long-term visibility. The company will be able to deliver a higher growth trajectory than its competitors thanks to a solid deal pipeline and strong revenue growth momentum in the Services vertical as well as in Allied businesses.

Persistent reported operating profit growth of 15.5% and its record ROCE of 25.9% for Q3-FY23. Market Mojo has chosen Persistent as one of its Mojo Stock with a buy rating. The stock traded at Rs 3,961 on 18th Jan 2023. Despite the expensive valuation, 17 of 26 online brokerages rate the stock as Buy/Strong Buy according data compiled by Trendlyne.

Disclaimer: Investors are advised to make their own informed decisions.

A few related graphics:

(Information compiled from internet sources)

Write Comment |

Write Comment |  E-Mail To a Friend |

E-Mail To a Friend |

Facebook |

Facebook |

Twitter |

Twitter |

Print

Print