Union Budget 2021-22: A perspective

By Philip Mudartha

Bellevision Media Network

Introduction:

Last Monday, the 1st February 2021, Finance Minister (FM), Nirmala Sitharaman, presented to the Lok Sabha the Union Budget for FY 2021-22. Since then, a bevy of economists and policy analysts have assayed and passed their expert verdicts. In fact, the stock brokers were the first to react as the FM was speaking; the Sensex zoomed by over 2,000 points before the day ended, an all time day record.

However, the budget is nothing more than an annual book keeping exercise. Households too periodically tabulate income and expenses. Most households earn more than they spend, and save for the rainy days. But, the Government of India (GoI) spends more than it earns. The government borrows from the public (internal debt) and from abroad (external debt) to finance the shortfall. Every year, GoI issues its sovereign debt bonds at ‘attractive’ interest rates.

The Big Hole in GoI finances:

The FY 2021-22 budget estimates an expenditure of Rupees 34, 83,236 crore. Of which, largest share of Rupees 8, 09,701 crore is the interest burden on its outstanding debt. Unfazed, the GoI aims to borrow more by a whopping Rupees 15, 06, 812 crore during the year. Due to this alone, it truly a ‘historic’ once in a century budget, as FM described it in her speech. By a stroke of her pen (mouse, to be precise), she threw out of the window all pretense of abiding by the Fiscal Responsibility and Budget Management (FRBM) Act, 2003. We have ‘spent, spent, and spent’, she boasted!

As on 31st March 2019, the outstanding debt burden was Rupees 1, 30, 23, 102 crore. During FY 2019-20, GoI borrowed Rupees 9, 33, 651 crore. Further, during FY 2020-21 (current year) its borrowings are estimated to be Rupees 18, 48, 655 crore. The FM estimates to borrow Rupees 15, 05, 812 crore during FY 2021-22 (coming year). Thus, as on 31st March 2022, the GoI finances will have a big hole of Rupees 1, 73, 11, 220 crore.

In May 2014, Modi came to power promising a government with a difference and minimum government maximum governance. Did he walk the talk? He inherited a debt burden of Rupees 75, 66, 767 crore on 31st March 2014. In his eight years, the debt burden will have risen by Rupees 97, 44, 453 crore. In seven years, Modi governments have borrowed a lot more than what previous governments borrowed in 66 years since independence!

Once again, a few definitions:

1. Fiscal Deficit: It is the excess of what the amount the government plans to spend over what the government expects to receive. The FRBM Act-2003 had mandated that the fiscal deficit shall be at 3% of nominal GDP.

2. Revenue Expenditure: It is the expense for running the government. For example, paying salaries and pensions is counted as revenue expenditure.

3. Capital Expenditure: Money invested to create new productive capacity in the economy is Capital Expenditure. For example, building a road or a factory, which increases the economy’s capacity to produce more, is counted as capital expenditure.

4. Revenue Deficit: It is the gap between revenue expenditure and revenue receipts. It is imprudent to borrow money to finance revenue deficit. The FRBM Act- 2003 had mandated that revenue deficit shall be nil. This means that the fiscal deficit is entirely to fund capital expenditure.

5. Nominal GDP is total value of goods and services the country produces at current prices. It is not real GDP, which is measured at fixed prices of a ‘base’ year.

In other words, the GoI is bound by law to borrow only to build new economic assets and not to run the administration. And the investments shall not exceed 3% of nominal GDP. The union budget pegs nominal GDP for FY2021-22 at Rupees 222.9 lakh crore, a 14.4% increase over the revised estimate for FY2020-21. This means the law binds GoI to limit its borrowings to 6.687 lakh crore. In borrowing Rupees 15.068 lakh crore, the FM has taken a ‘historic’ decision NOT to abide by the rules of fiscal discipline.

The numbers tell the real story:

1. The GoI does not abide by the mandate of FRBM Act-2003. It estimates to incur a revenue deficit of Rupees 11, 40, 516 crore which is 5.12% of nominal GDP higher than the norm of 0%.

2. The capital expenditure is pegged at Rupees 5, 54, 236 crore, which is about 2.49% of nominal GDP, lower than the norm of 3%.

3. The fiscal deficit is pegged at Rupees 15, 06, 812 crore which is 6.76% approx of nominal GDP higher than the norm of 3%.

4. The FRBM Act-2003 provides for emergency exemptions. The COVID-19 pandemic has inflicted great economic costs on the nation. The sudden and unplanned national lockdown in March-April 2020 brought all economic activities save essential services to a halt. The containment measures adopted and still in force after several rounds of ‘Unlock’ continue to result in GDP contraction. Jobs have been lost. Many small and medium businesses have closed down. Private consumer spending is abysmally low. In such gloomy environment, the GoI has increased its revenue spending ostensibly to spur demand.

5. The national exchequer had to bear the costs of feeding the poor and unemployed migrant labor who returned to their native villages using the food-grains stocks with the Food Corporation of India (FCI). The announced relief package is pegged at Rupees 20 lakh crore, which took the revised estimate of fiscal deficit for FY 2020-21 (current year) to 9.8% of nominal GDP.

Budget Highlights:

Analysis:

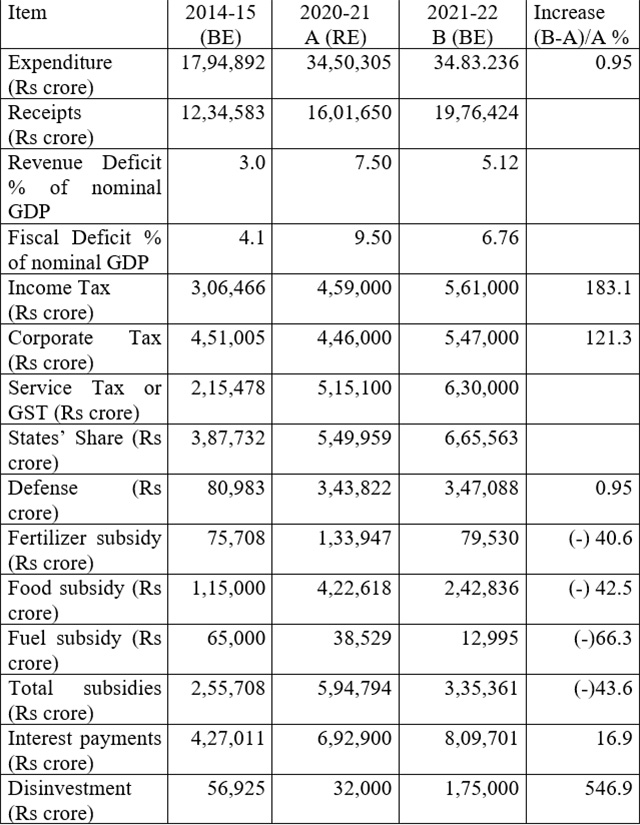

The 2014-15 data is from the union budget of Modi-1.0 presented by then FM late Arun Jaitley. The 2020-21 RE are Revised Estimates for the current year, presented by FM. The 2021-22 BE are Budget Estimates by FM. The table gives a glimpse on key parameters over seven years of Modi government.

1. Over the seven years, the personal income tax collections have increased by 83% while corporate tax collections have gone up only 21%. Individual income tax payers have not received any tax breaks. Whereas, corporate tax rates have been slashed, stating that collections will rise. That did not happen. There is truth in the opposition’s charge that it is ‘suit-boot ki sarkar’.

2. The defense expenditure increase by 134% is due to increase in salaries, pensions and purchase of military equipment during the six years. Despite the Chinese aggression, the allocation is only 0.95% higher for next year.

3. The overall subsidy burden is 31% higher compared to seven years ago. But, 43.6% lower than current year. To feed the jobless, poor and marginalized during the current year, the government spent large amounts on free or subsided food grains. The government is rolling them back. Compared to seven years ago, a) the fertilizer subsidy has not changed much; b) the fuel subsidy has come down drastically to only 20% despite the Ujwala scheme. The LPG, petrol, diesel and LNG prices have been kept high (in spite of lower crude oil prices in the international market). Additionally, the FM introduced new central cesses on petrol and diesel which will soon send their pump prices skyrocketing!

4. Predictably, the interest payments on outstanding debt have risen to 190% as the Modi government has been on a borrowing spree during these seven years.

5. Disinvestment dubbed as “selling family silver” by all political parties while in opposition is a source of capital receipts. This budget targets to collect Rupees 1, 75,000 crore by ‘strategic privatization’. The details are yet to be announced. Two public sector Banks (PSB) and an insurance company will be privatized in addition to LIC’s Initial Public Offering (IPO).

Industry and the stock market’s reaction:

Some economists joined the industry tycoons and the stock brokers in praising the budget for doing the right thing. Prior to the Covid-19 pandemic, the economy was already slowing. The pandemic wrecked it completely. Of late, signs of a V-shaped recovery are there. The stock market is booming with Sensex at an all time high.

Auto industry welcomed the announcement of a voluntary scrappage policy for old automobiles (aged 20 years plus for passenger vehicles and 15 years for commercial vehicles). In a knee-jerk reaction, the auto sector stocks saw double digit upside every day during the week.

The industry welcomed the commitment to upgrade the road infrastructure with projects for building 8,500 km of highways and economic corridors. The allocation of Rupees 18,000-crore to public transport in urban areas with the addition of 20,000 new buses in a PPP model would ease congestion, they opined.

The Health & Wellness allocations:

The pharmaceutical industry and chief executives of private hospitals too joined the chorus and welcomed the priority assigned to Health & Wellness.

The budget outlay is Rupees 2, 23,846 crore, including the allocation of ?35,400 crore towards COVID-19 vaccinations. The GoI, in association with state governments, has already started the Covid-19 vaccination drive, beginning with frontline healthcare personnel.

A closer look indicates that the FM has clubbed the allocations to ministry of drinking water & sanitation, ministry of finance (for COVID-19 vaccines), and department of nutrition under Health & Wellness, a new accounting trick. The actual H&W increase is 10% from Rs 65, 012 crore to Rs 71, 269 crore.

The increase in FDI in insurance was welcomed:

This was a pet scheme of all past governments since 1996. Vajpayee government allowed private players to enter while capping FDI at 26%. UPA government raised it to 49%, which was vehemently opposed by Modi while in opposition. And Modi-2.0 just announced an increase to 74%!

With management control, the foreign owners are sure to buy the ballooning GoI sovereign debt.

Other positives welcomed:

1. Initiative to set up a Development Finance Institution (DFI) to promote and fund major infrastructure projects.

2. Capital outlay of Rupees 1.10 lakh crore to Indian Railways. The announcement of Dedicated Freight Corridors (DFCs) and a policy decision to “monetize” the DFC assets means the entry of private players in ‘operations & maintenance” of rail tracks.

3. Privatization of two PSBs, Air India and LIC.

4. The setting up of a “Bad Bank” termed as “Asset Reconstruction Company (ARC)”. What is ARC? Its function will be to take over all the bad loans (non-performing assets, NPAs) of PSBs and try to recover them. The PSBs with a “clean” loan book can then focus on renewing the loan portfolio and aggressive deposit mobilization. This is an old idea proposed by former RBI Governor Rajan and has been in public discourse for some time.

Criticisms by opposition and social activists:

1. "India’s first paperless budget is also a 100% visionless budget. Theme of the fake budget is Sell India!" TMC spokesperson Derek O’Brien said.

2. Congress termed the budget as “directionless”, “a national sell-out”, and “timid” in extending help to the poor. However, it welcomed the ‘one nation, one ration’ and increased public health expenditure as two positives.

3. The most common criticism was that it focused on the election-bound states. Most of the infrastructure projects, especially building roads and highways, were announced in the states going to polls, like Assam, West Bengal, Kerala and Tamil Nadu.

4. The expectations that personal income tax threshold would be revised upwards was belied. A token gesture of exempting very senior taxpayers from filing income tax returns with the provision that their income should only be from pensions and bank deposits in the same bank in which the pensions are received.

5. Public investment in infrastructure can crowd in private investment to accelerate growth. It is arguable whether this is better than putting more income in the hands of people suffering from job or income loss, and struggling small businesses.

6. The outlay for education is increased by a mere 4.2% to Rs 93,224 crore. The All India Federation of University and College Teachers Organization (AIFUCTO) termed this budget as a move to “destroy” the public-funded education system. Most of the allocation goes to eminent institutes of higher education which benefits the rich. The allocation to mass education has gone down. The allocation for mid-day meal scheme has been cut down by Rs 1400 crore. In jobs & skill development, the allocation has been cut down by 35%. (Probably, the states are expected to take care of it!)

7. Overall expenditure towards social sector has been slashed by 40% compared to current year.

Summing Up:

The FM termed her budget as never before, once in a century document. Hers was a good speech which was applauded immediately by the corporate sector and the core base of the ruling party. Much praise was heaped on her “bold” decision NOT to comply by FRBM Act-2003 and not worry about fiscal discipline. The pandemic had forced the government to spend anyway. In fact, the total expenditure for next year is only 0.95% higher. If 4% inflation (the RBI goal, not actual) is accounted for, the expenditure will be 3% lower than current year. So, it is maintaining the “actual” financial condition of the country without rocking the boat!

Write Comment |

Write Comment |  E-Mail To a Friend |

E-Mail To a Friend |

Facebook |

Facebook |

Twitter |

Twitter |

Print

Print