The collapse of YES bank and the distress in the national economy

By Philip Mudartha

Bellevision Media Network

Prelude:

It is March 6, 2020 and the time is 4:00PM, when the Bombay Stock Exchange (BSE) has closed its trades for today. Today’s top story is the tanking of shares of YES Bank on the bourse, which began yesterday when the RBI superseded the Board of Directors of the stressed bank and appointed a former Chief Finances officer (CFO) of central government controlled public sector bank, the State Bank of India (SBI) to oversee the corporate management of the beleaguered bank. The stock of face value Rs 2 closed at Rs 16.15, at which the Price/Book ratio is only 0.15; any value below 2.0 is considered abnormal. It just shows how bad the books are and the extent of gross stress assets. Despite the risk of retail investors losing all their money, there are more buyers than sellers at the time of writing!

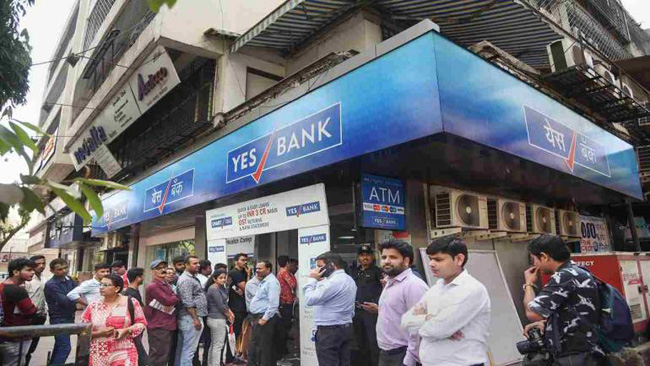

However, panic set in and depositors flocked to bank ATMs in a run on the bank. When ATMs ran dry, they queued up at the bank’s branches to withdraw their money. RBI was swift in capping the withdrawal at Rs50, 000 per person for this month. The pictures brought back vivid memories of the bank run by depositors of Punjab & Maharashtra Co-operative (PMC) Bank on 23rd September 2019. PMC Bank had its largest borrower default on the loans which it advanced to one of the bank’s directors without due diligence of his assets in the real estate sector.

YES Bank and PMC Bank are stories of recent past. In mid-2004, Global trust Bank (GTB), a private sector bank with many retail investors and middle class depositors sank. The Government merged it with Overseas Bank of Commerce (OCB), a state-controlled bank. The depositors’ money was saved but the shareholders did not receive anything!

Definitions:

Because this feature is about money and banking targeted at laypeople, I will explain rudimentary terms such as banking, liabilities, gross assets, non-performing assets (NPA), and Net Worth as well as Price/Book ratio.

Banking is about your money. A licensed money-lender governed under Banking Regulations Act-1949 solicits, receives and documents in its books retail deposits from the public in current, savings and fixed term accounts at published interest rates. The aggregate amounts of deposits along with the interest accrued or due are the liabilities of the bank. Because, these are monies owed to the depositors.

Banking is about lending your money to borrowers at a higher rate of interest than it pays/owes to the depositors. These are loans advanced to those who borrow to fund their businesses and retail expenditure like children’s education, acquisition of a home for self-occupation or properties for investment, durables such as automobiles, and household white goods, hosting parties on the occasion of weddings, other family events and festivals. Those who borrow for businesses may be from big corporate houses or small retail shopkeepers/entrepreneurs. The former are often more powerful than the lender banks while the latter are usually at the mercy of the banks. All loans and advances are the gross assets of the bank.

The interest amounts earned/received on loans and advances is the gross revenue of the bank. The interest rates difference between the rates for assets and liabilities is the spread and usually is not less than 3%. This finances its other liabilities such as expenditure for rent/upkeep of the premises, staff salaries, utilities, taxes and levies etc. If the cost of funds it borrowed from depositors is, say 6% in average, then it should lend at, say 9% minimum in order to make net profit from its operations.

All is not as simple as this! Borrowers, especially big corporate houses, default on their loans repayment or interest payments. Some businesses, big and small, fail or make losses and even go bankrupt. While the investors in the company shares lose their money, the lending banks assign these advances as NPAs in their books. Mounting NPAs limit the lending capacity of banks. Either the lending rates should go up or the borrowing (from depositors) rates should go down or both. However, in a competitive market place, there is not much the banks can do to survive other than a) lowering its NPAs, b) improving its operational efficiencies, and c) raising new capital. Easier said than done!

The Net-Worth (NW) of a bank is its total assets minus its total liabilities. It is also termed as Bank Equity (BE). If BE is negative, the bank is in the red and it needs a savior who is willing to infuse fresh capital and throw a lifeline.

The BE can be considered as the book value of shareholders’ equity on a bank’s balance sheet. Typical items featured in the book value of shareholders’ equity include preferred equity, common stock, and paid-in capital, retained earnings, and accumulated comprehensive income. The book value of shareholders’ equity is also calculated as the difference between a bank’s assets and liabilities. The Price/Book ratio is the extent of market capitalization of a bank, which is the current market price of a market lot of its common stock divided by its Book Value (BE).

It is important, therefore, to have sound book-keeping and accounting practices. If the banks comply by Basel III banking regulations, the depositors and investors in equity can be assured of safety of their funds. It is not the scope of this article to get deeper into these supervisory safeguards.

The Case of mounting NPAs in Indian Banks:

A year ago, the Standing Committee on Finance released a report on the banking sector in India: It observed that banks’ capacity to lend has been severely affected because of mounting NPAs. The Estimates Committee of Lok Sabha is also examining the performance of public sector banks with respect to their burgeoning problem of NPAs, and loan recovery mechanisms available. Multiple being are filed in courts against the loans defaulters. In this context, let us examine the rise of NPAs, their underlying causes, and steps taken to address the problem.

Let me begin with the strengths and weaknesses of major Indian banks. They are very good on the side of liabilities: they can amass deposits with ease at reasonably low interest rates. This is their strength. With voluntary retirement of employees who cannot be trained to use new technology tools, the new workforce is younger, tech savvy, hard working and motivated to put in longer hours than normal banking hours. But, their weakness lies in the side of assets. They simply do not go out and lend to the wider populace who need loans and from whom the receivables can be collected on time. Instead, the decisions to lend are made mostly in boardrooms or at higher executive levels. Such decisions favor big corporate houses, behavior which I term as cronyism!

To understand cronyism, let me explain the three Indias within India: 1) India-1 whose monthly take home income is over Rs 50,000 2) India-2 whose monthly take home income is less than Rs 50,000 but over Rs 15,000 and 3) India-3 whose monthly take home income is below Rs 15, 000. India-1 is around 7% of our population, India-2 is around 18% and India-3 is the majority 75%. Our major banks lend 75% of their assets to India-1 which is notorious for mismanagement of funds which ore not theirs own. They afford expensive lawyers to fight civil cases for ages, up to the Supreme Court and lock up the banks in litigation to forestall loan recovery. Umpteen examples are known: Vijay Mallya, Nirav Modi, Venugopal Dhoot, Ruia Brothers and Anil Ambani are a few much publicized bad apples. India-2 receives probably the remaining 25% and India-3 receives nothing! If the reverse were true, which is if the bank branches disburse over 80% of their deposits as loans to small and medium borrowers of India-3 and India-2, their risk of bad loans would have been very low.

But, such restructuring of banking operations requires democratizing of bank management and operations, putting the branch manager in-charge of both deposits mobilization and disbursal of loans. Most of our banks, including the new and modern private sector banks are top-heavy and assign for the top executives the power of doling out loans which they do to their own favorites among the big industrialists and business tycoons. Take the example of Chanda Kochhar, the CEO&MD of ICICI Bank, who is under CBI investigation for the bad loans of over three thousand crore rupees disbursed to now defunct Videocon group in exchange for alleged favors received by her husband and the stressed Essar Group. ICICI Bank is the second largest private sector bank in India, only a notch lower than HDFC Bank.

The much-maligned public sector banks are not in any better shape: as on March 31, 2018, NPAs stood at Rs. 8, 95,601 crore to which Rs. 2, 16,763 crore was added in 2018-19. Rs. 1, 33,844 crore was recovered and Rs. 1, 83,391 crore as written off to “window dress” the books! Thus, the closing figure as on March 31, 2019, was Rs. 7,39,541 crore. State Bank of India (SBI), the premier public sector bank in India alone accounts for over Rs. 2, 23, 000. The primetime TV news at 8:00 PM announced that SBI will take 49% stake in YES bank in order to salvage the near-bankrupt private sector bank. This is a sad commentary on “privatization” of national Navaratnas, especially BPCL, NTPC and LIC.

It is not the economy, Stupid!

The massive mandate which Modi and his party, BJP, got in the national general elections in May 2019 belied the statement that “it’s the economy, stupid”. Despite the national economy in distress, the GDP growth faltering, farmers’ incomes falling and agrarian economy stressed, unemployment rate soaring to a 45-year high, retail consumer price inflation climbing above the GDP growth rate, thus putting less and less money in the hands of India-3, the incumbent central government did not face anti-incumbency. The muscular nationalism combined with hardcore Hindutva socio-cultural agenda of dismantling the Nehruvian Idea of India and the right-wing propaganda of “the government has no business to be in business”, won the ruling elite a second five year term. Beginning with the disastrous “demonetization” (now discredited) and a faulty implementation of GST has killed many MSME owned by lower rungs of India-2 and India-3. The non-banking finance corporations (NBFCs) crisis symbolized by the collapse of IL&FS has once again driven the “micro financing” to the nadir, causing a liquidity crisis and forcing the rural self-employed entrepreneurs to the clutches of local ‘moneylenders”.

What is sadder is that the central government is busy pushing its aggressive socio-cultural agenda with its enacting of Triple Talaq Act, Abrogation of Article-370 and the lockdown in Kashmir Valley, of overseeing the construction of Ayodhya Ram Mandir, Citizenship Amendment Act-2019, and Enactment of laws to the nation-wide implementation of National Register of Citizens (NRC), National Population Register (NPR) along with Census-2021 and Uniform Civil Code (UCC). The tanking economy has taken a back seat which the government does not even recognize is a problem. Other than blaming the “legacy” of a regime which has been voted out more than six years ago, the Finance Minister (FM) does not seem to have any clue how to address the distress in all sectors be it banking, auto-and auto-ancillaries, telecom and FMCG.

| Comments on this Article | |

| Peter P. Saldanha, Kabyadi / Pamboor | Sun, March-8-2020, 9:37 |

| Very good article. We all had hope on Modiji that he will end corruption and we will see Acche Din. People under India-2 and India-3 categories that you mentioned are suffering for no fault of theirs. Unless the government enforces strong measures and laws to recover bad loans especially given to Corporate houses or businesses run by close relatives of bank executives, this will continue to hurt Indian economy and the common man. Modiji has been screaming at the top of his lungs that we will soon be a 5 trillion economy but without clear plans and milestones to reform the economy, this seems to be a far stretched goal than a committed one. The Indian voters need to realize the false notion of nation building and demand answers from this government; the sooner the better. | |

Write Comment

Write Comment E-Mail To a Friend

E-Mail To a Friend Facebook

Facebook Twitter

Twitter  Print

Print